February 2024:

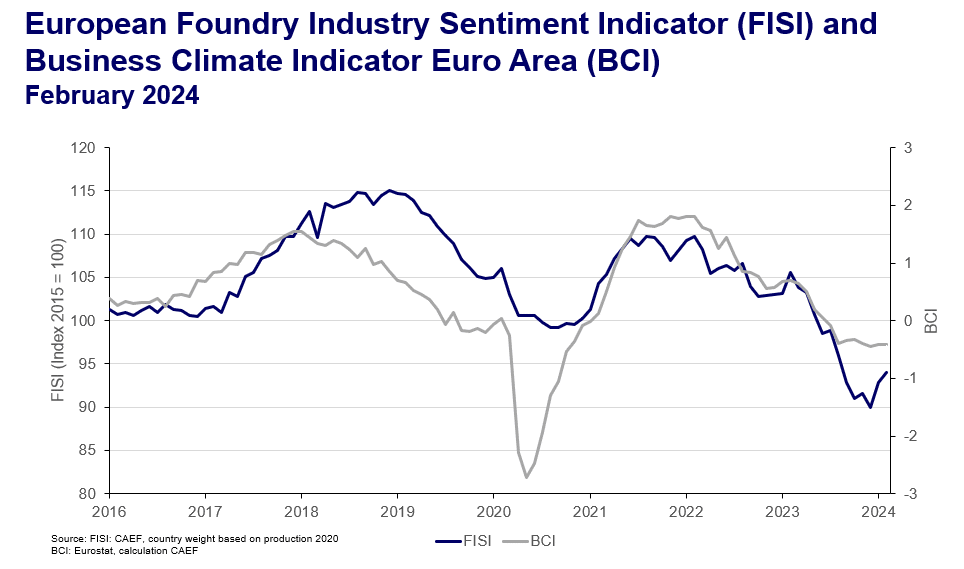

Following a rise for the second month straight, FISI now stands at 94 index points.

In February 2024, the European Foundry Industry Sentiment Indicator (FISI) experienced a pleasing surge, with an uptick to 94.0 index points. This development reflects the second

consecutive increase for the FISI, the index experiences an increase of 1.1 points, settling at 94.0 compared to 92.9 in the previous month.

The current uptick in sentiment may partly be attributed to a moderation in the situation across procurement markets, contributing to a mild easing of pressures. The pricing dynamics of raw materials have settled into a new normal, persisting at levels that exceed those observed prior to the onset of the pandemic. However, it is essential to highlight that the overall situation remains tense, with considerable obstacles still to overcome. The industry faces ongoing challenges like fluctuating demand and global economic uncertainties. These factors

underscore the fragility of the current improvement and emphasize the need for sustained efforts to stabilize and strengthen the sector. While the small improvement in February is a

positive sign, it’s important to remember that the European foundry industry still has a tough road ahead. Staying alert and taking proactive steps will be vital to deal with the ongoing

challenges and ensure that the industry stays strong in the face of adversity.

Meanwhile the Business Climate Indicator (BCI) remains unchanged at ‑0.42 index points, mirroring its value from January. This marks the eighth consecutive month that the BCI has

lingered below the critical threshold of 0 index points. Once again, the negative trend in the BCI primarily stems from the assessment of export order-book levels, a reflection of persistent

challenges in this aspect. The ongoing geopolitical tensions in regions such as the Middle East and Ukraine continue to exert significant influence on this trajectory, contributing to the

sustained stagnation in the BCI.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: johannes.kappes@caef.eu