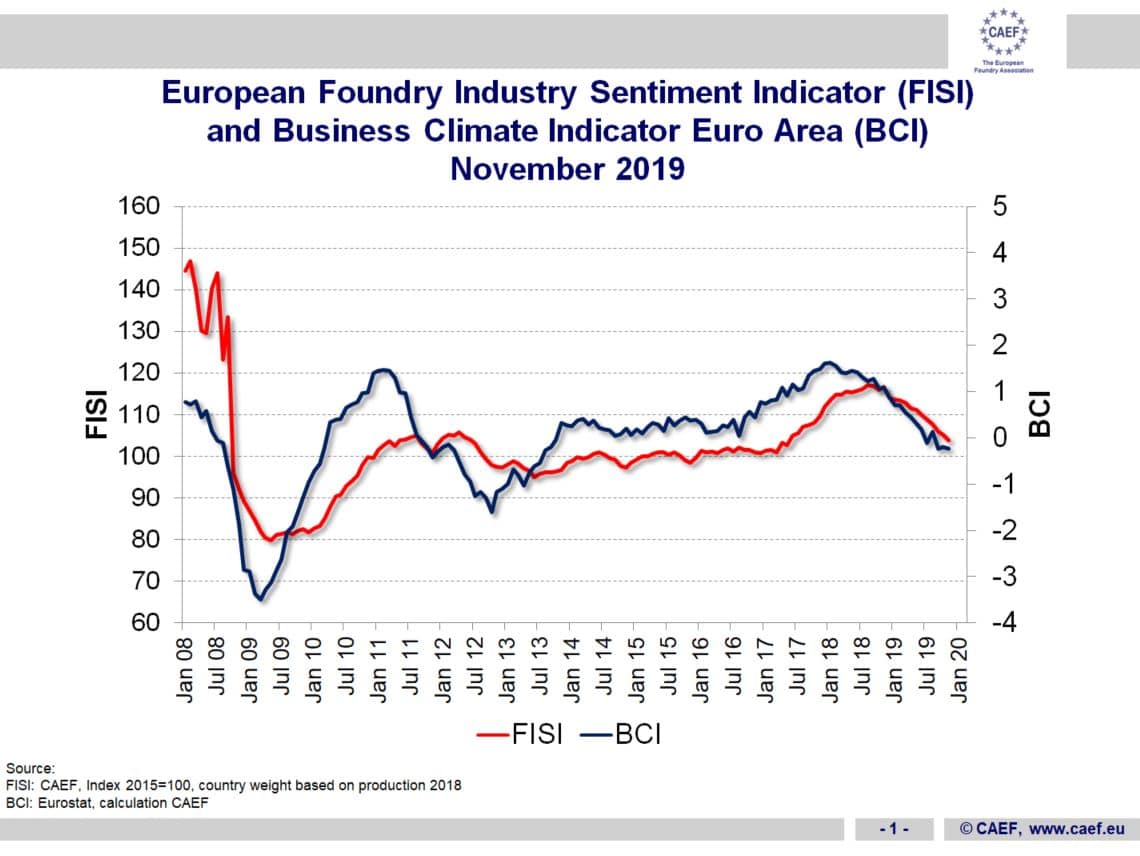

November 2019: Ongoing downward trend

The European Foundry Industry Sentiment fell slightly in November. The European foundries are still not satisfied with their current business situation. Their expectations for the next six months are muted in November. Only the expectations of non-ferrous foundries improved slightly. Also manufacturers in the euro area expect an improvement in production. Therefore, the Business Climate Indicator remained broadly unchanged in November.

The main customers of the foundry industry – automotive and general engineering industry – are still under pressure. Hence, foundries barely plan production expansions for the coming months. Moreover, it is not guaranteed that trade tensions will ease in the long-term. After countless months of negotiations and additional duties, the US and China both agreed to the “Phase-1-Deal” recently, in December. But the US presidential elections are coming up and the “Phase-2-Deal” includes negotiations regarding very controversial issues. Moreover, the decision about 25 percent punitive tariffs on European passenger car and component deliveries to the US has only been postponed by six months. How this environment will affect the foundry business climate at the end of the year will soon become apparent.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by the European Foundry Association (CAEF) every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Sophie Steffen

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

sophie.steffen@caef.eu