May 2023: Downhill slide picks up speed

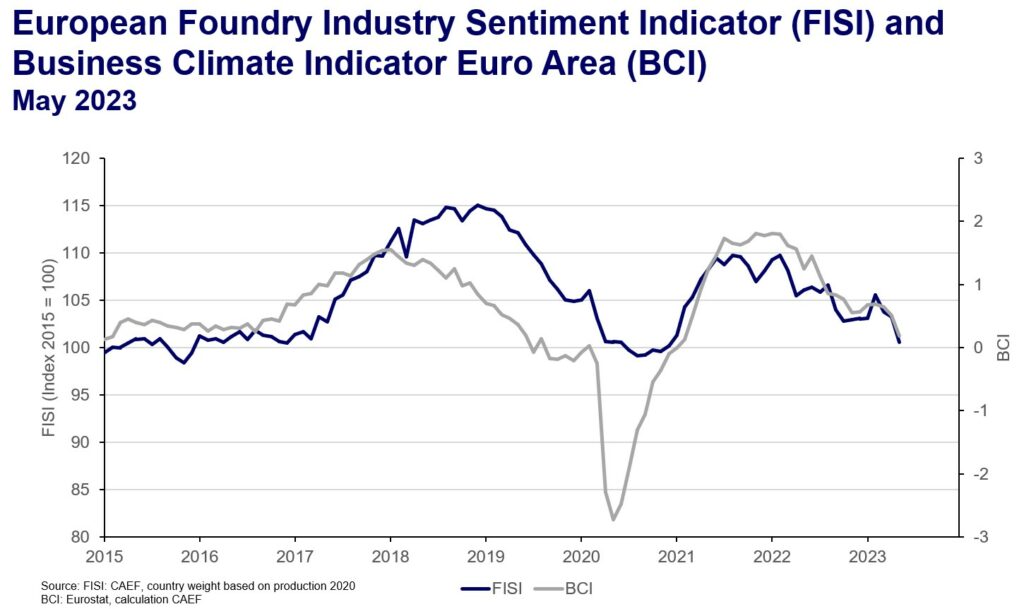

The European Foundry Industry Sentiment Indicator (FISI) records the third decrease in a row. Rating of 2.7 index points lower than in April, the index reaches a value of 100.6 points in May. This marks the biggest drop since the outbreak of the war in Ukraine. It is alarming that the negative trend is thus intensifying.

While order backlogs are being worked off, new orders continue to collapse in many sectors. Meanwhile, a turnaround is not in sight. At the same time, there is also a lack of international impulses that could stimulate demand via second-round effects.While, in the last months, the development of steel and iron foundries on the one hand and non-ferrous metal foundries on the other hand was contrary due to statistical base effects, foundries of all material groups are currently turning negative in their assessment of the business situation compared to the previous month.

The Business Climate Indicator (BCI) decreases by 0.32 points in May and brings the index to 0.19 points. This marks the biggest decline since the outbreak of the pandemic in Europe in April 2020. Overall, the selling price expectations for the month ahead are decreasing together with the current production level and the order book levels.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu