April 2024:

European Foundry Industry Sentiment, April 2024: After a remarkable development in Spring, FISI takes a breath and now stands at 95.1 index points.

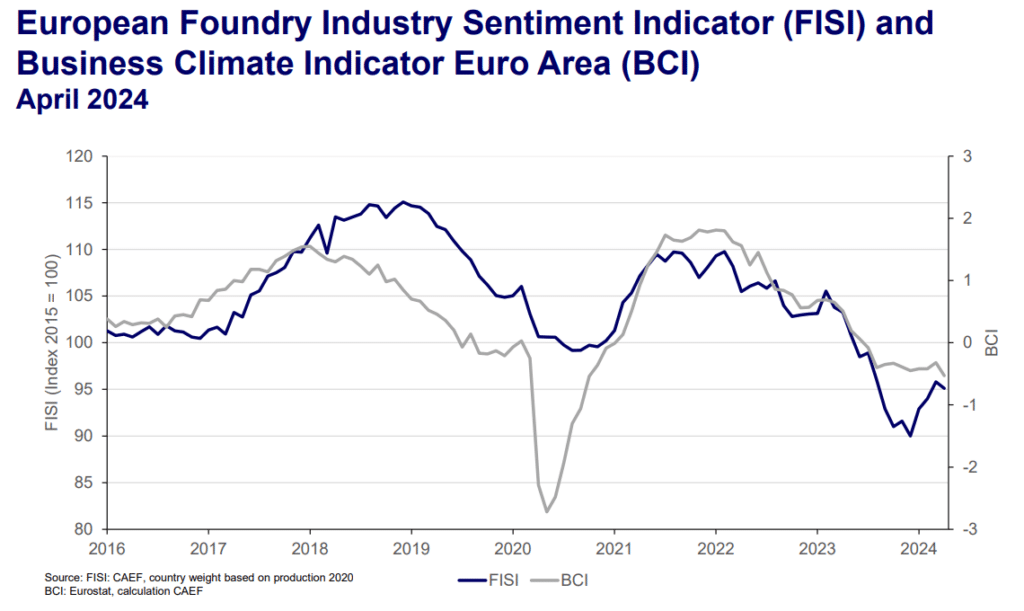

In April 2024, the European Foundry Industry Sentiment Indicator (FISI) experienced a decrease to 95.1 index points. After three consecutive increases for the FISI, the index

experiences a decrease of 0.7 index points, settling at 95.1 points compared to 95.8 points in the previous month. While the European Foundry Industry Sentiment Index had shown improvement over the last three months, it now seems to be stabilizing, reflecting a period of catching breath. Raw material and scrap prices have seen little change during the past month, which supports the general sideways movement of the FISI. April has been a month of holding steady for the industry, and this trend is likely to continue through the summer months. Political initiatives that could impact trade activities are not expected until late autumn at the earliest. In the meantime, companies are focusing on internal optimizations and strategic planning to navigate the current uncertainties. Stakeholders are also closely monitoring global market developments to anticipate potential shifts in demand and supply chains.

Meanwhile the Business Climate Indicator (BCI) decreased noticeable and now stands at — 0.53 index points. This marks the tenth consecutive month that the BCI has lingered below the

critical threshold of 0 index points. The main reason for the significant reduction is the production trend observed in recent months. This downturn suggests that businesses are facing increased uncertainty and pressure, which may hinder their growth prospects. Consequently, companies need to adopt more cautious strategies to navigate the current economic landscape.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: johannes.kappes@caef.eu