January 2022: European foundries are starting the new year with confidences

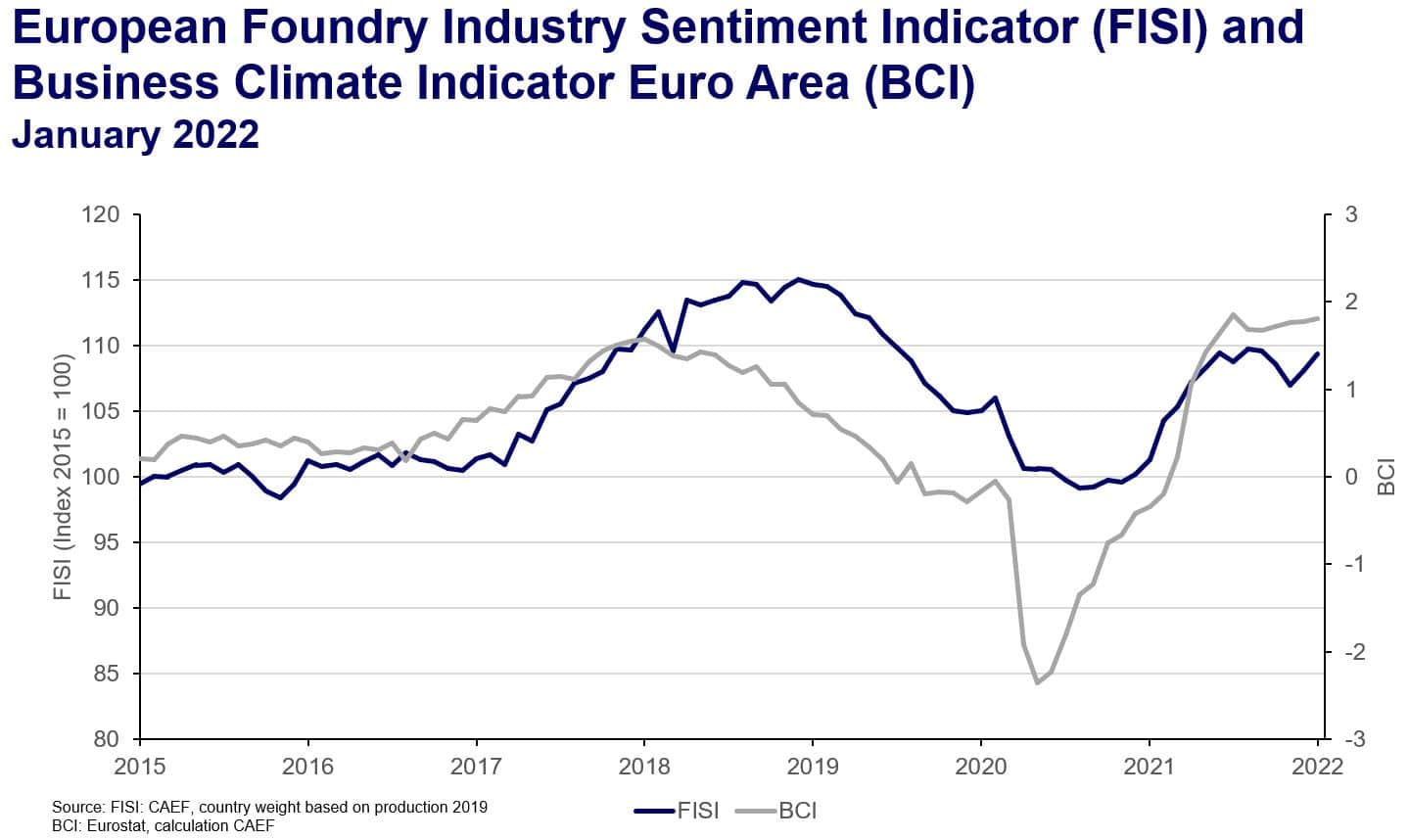

The European Foundry Industry Sentiment Indicator (FISI) increases by a solid 1.31 points at the start of 2022 and reaches a value of 109.4 points. This marks the greatest month-on-month improvement since April 2021. The European foundries have left the poor second half of the previous year behind for the time being thanks to the dynamic and positive trend of the last two months. It is an encouraging development that iron, steel and non-ferrous metal foundries all assessed the current situation and expectations for the upcoming six months more positively in January than in the previous month. However, there are differences in the degree to which they evaluate both. While the assessment of the current business situation has improved moderately overall, the FISI is mainly driven by more optimistic expectations.

Since the health systems are not experiencing overload despite the numbers of corona infections that exploded in January in most parts of Europe, the signs are set for normalisation. The economy is therefore expecting fewer staff absences and supply chains returning to normal.

For now, this news matters more than the still high energy prices. Signs of de-escalation in the conflict between Ukraine and Russia would also be important for the European industry in this respect. Accordingly, an escalation of the situation would have a significant impact on the economy given the energy dependency and the direct European neighbourhood.

At the same time, the Business Climate Indicator (BCI) remains on a high level in January. The slight increase of 0.03 points brings the index to 1.81 points. Main drivers are the export order-book levels and the assessment of stocks of finished products.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by the European Foundry Association (CAEF) every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu