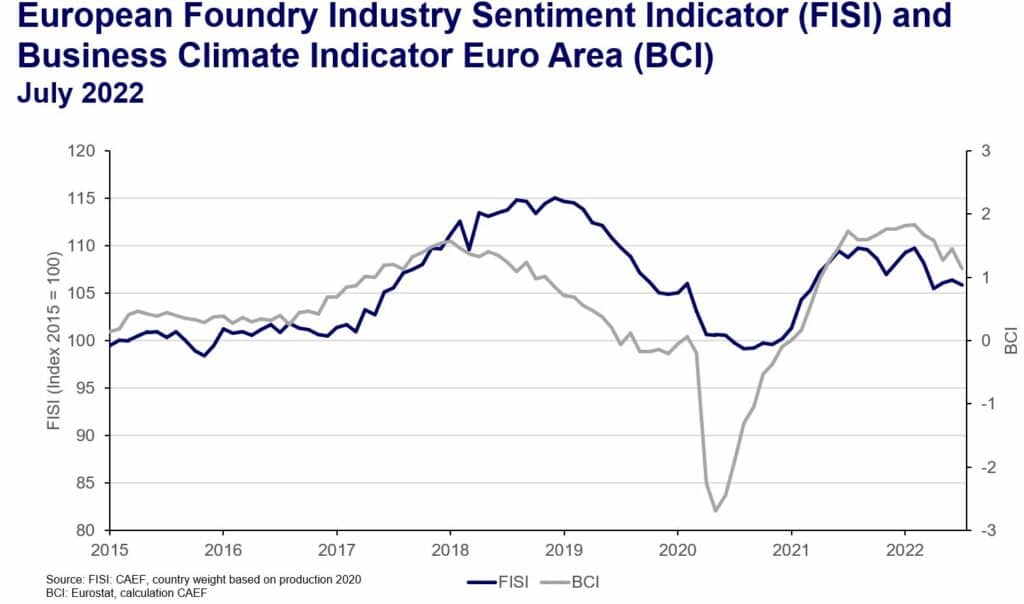

July 2022: Gap between sentiment of situation assessment and expectations has never been greater

The European Foundry Industry Sentiment Indicator (FISI) decreased by 0.6 points in July and reaches a value of 105.8 points. It continues to be the case that two different trends are apparent in the composition of the FISI. While the current situation is still considered positive by many foundries due to the very good order situation in the mechanical engineering sector, the expectations for the next six months are on the downturn. There has never been a greater difference between the assessment of the situation and the expectations since the beginning of the data collection. Tensions are rising, especially as signs of a slowdown in demand are intensifying.

It should be noted that the non-ferrous metal foundries have even supported the FISI recently, as improvements in the supply of semiconductors in the weighty automotive industry are gradually becoming noticeable. However, these are statistical base effects, as the base level is exceptionally low after the past two years of crisis.

The very high level of inflation has forced central banks in North America and Europe to act. In addition, China’s economy is weakening due to problems in the construction sector. Rising interest rates and fears of recession are cooling the business outlook significantly.

Meanwhile the Business Climate Indicator (BCI) decreased in July. The increase of 0.31 points brings the index to 1.14 points. The considerable price increases of the past months affect demand more and more. New orders, recently, have been markedly declining. Although price expectations are still high, the peak in April has been seen off due to decreasing demand.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu