October 2022: Temperatures and the economy are cooling down

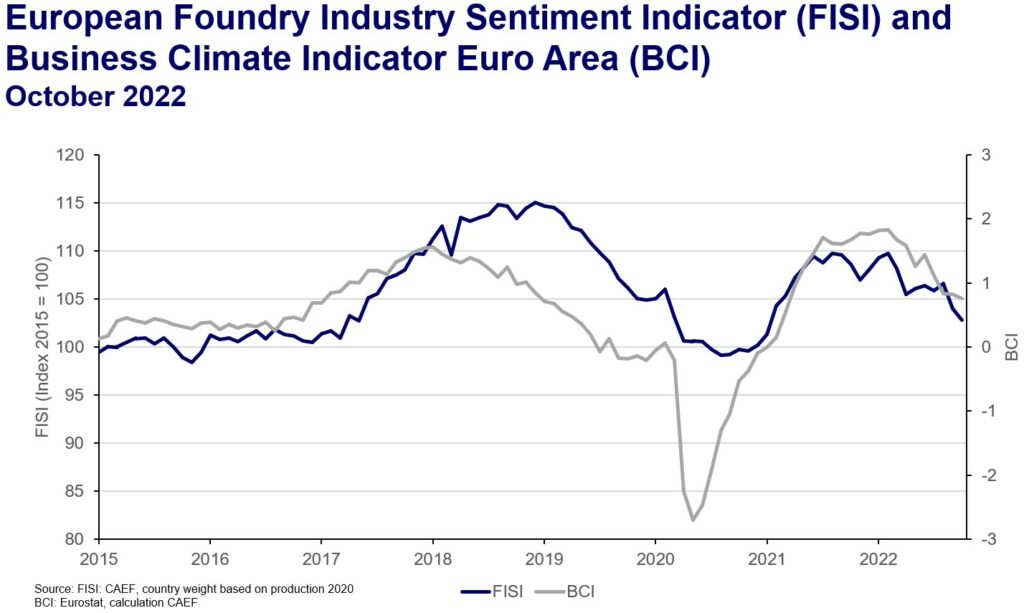

The European Foundry Industry Sentiment Indicator (FISI) decreased by 1.2 points in October and reaches a value of 102.8 points. Again, the overall expectations for the next six months and the assessment of the current business situation dropped. A closer look reveals that iron foundries report a significant decrease in the current business situation for the second time in a row, while the expectations for the next six months show no change compared to the previous month at a low base. The situation is different for non-ferrous foundries. Here, the assessment of the situation remains at the weak level of the previous month, while expectations continue to decline.

Looking ahead to the year 2023, there are stronger signs of a recession in several European economies. In its October forecast, the IMF predicts negative GDP growth rates for Germany (-0.3%) and Italy (-0.2%). And for other large economies, the adjustments to the forecasts for the coming year compared to the April forecast are in part serious. Although the forecasts for North America and Asia were also revised downwards, neither the expected GDP growth rates (USA 1.0%; China 4.4%) nor the forecast revisions compared to the last forecast reach the European level. It remains unclear how strongly demand for cast components will decline. While order books are still at a good level in many markets, incoming orders are already declining noticeably at the onset of winter.

Meanwhile the Business Climate Indicator (BCI) decreased in October. The decrease of 0.06 points brings the index to 0.76 points. An increased assessment of stocks of finished products and decreasing expectations of sales prices balance each other out.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu