October 2023:

Downward Trend Persists: European Foundry Sector witnesses another slide

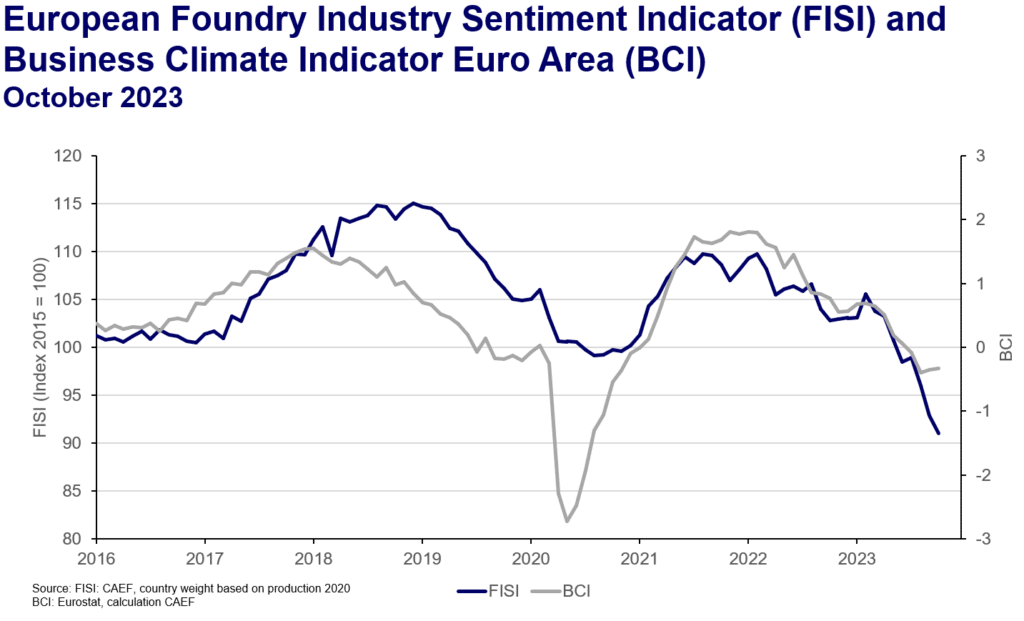

The European Foundry Industry Sentiment Indicator (FISI) has recorded again a decline, reinforcing the negative trend observed in September. With a decrease of 1.9 index points, the index now stands at 91.0, down from 92.9 last month.

The foundry industry faces numerous challenges, each contributing to its current decline. The most prominent factor is a substantial reduction in overall production levels in recent months. Furthermore, the ongoing discussions on economic policy primarily revolve around major industrial corporations, which are growing more doubtful about Europe as a favourable business location compared to North America. Foundries express significant concerns about the international competitiveness in general and surrounding the uncertainty and availability of raw materials and scrap. These intertwined factors collectively highlight the ongoing pressures faced by the foundry sector.

Meanwhile the Business Climate Indicator (BCI) stands at ‑0.33 index points in October. This marks the fourth consecutive time that the BCI is below the critical threshold of 0 index points. Even though the index improved as little as 0.02 index points from last month the situation is still very tense and, in some parts, pessimistic. The prevailing conditions echo those experienced in September 2023, with an evident feeling of uncertainty in the air. The negative BCI can be attributed, in part, to a less favourable assessment of order-book levels in combination to a reduction in production in recent months. Additionally, the employment expectation for the months ahead had a negative impact.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: johannes.kappes@caef.eu